4 Easy Facts About Pvm Accounting Shown

4 Easy Facts About Pvm Accounting Shown

Blog Article

How Pvm Accounting can Save You Time, Stress, and Money.

Table of ContentsThe Definitive Guide for Pvm Accounting8 Simple Techniques For Pvm AccountingThe Greatest Guide To Pvm AccountingAll about Pvm AccountingUnknown Facts About Pvm AccountingLittle Known Facts About Pvm Accounting.

Oversee and manage the creation and authorization of all project-related payments to clients to cultivate good interaction and prevent issues. financial reports. Make certain that proper records and documentation are sent to and are updated with the IRS. Make sure that the accounting process abides by the law. Apply needed building and construction accounting requirements and procedures to the recording and coverage of building task.Understand and maintain conventional cost codes in the bookkeeping system. Interact with various funding agencies (i.e. Title Company, Escrow Firm) regarding the pay application process and requirements required for payment. Manage lien waiver disbursement and collection - https://medium.com/@leonelcenteno/about. Monitor and fix bank problems consisting of cost abnormalities and inspect differences. Assist with implementing and maintaining inner economic controls and treatments.

The above statements are intended to define the basic nature and level of work being executed by individuals designated to this category. They are not to be understood as an exhaustive list of duties, responsibilities, and skills required. Personnel might be called for to carry out duties beyond their typical responsibilities every so often, as needed.

A Biased View of Pvm Accounting

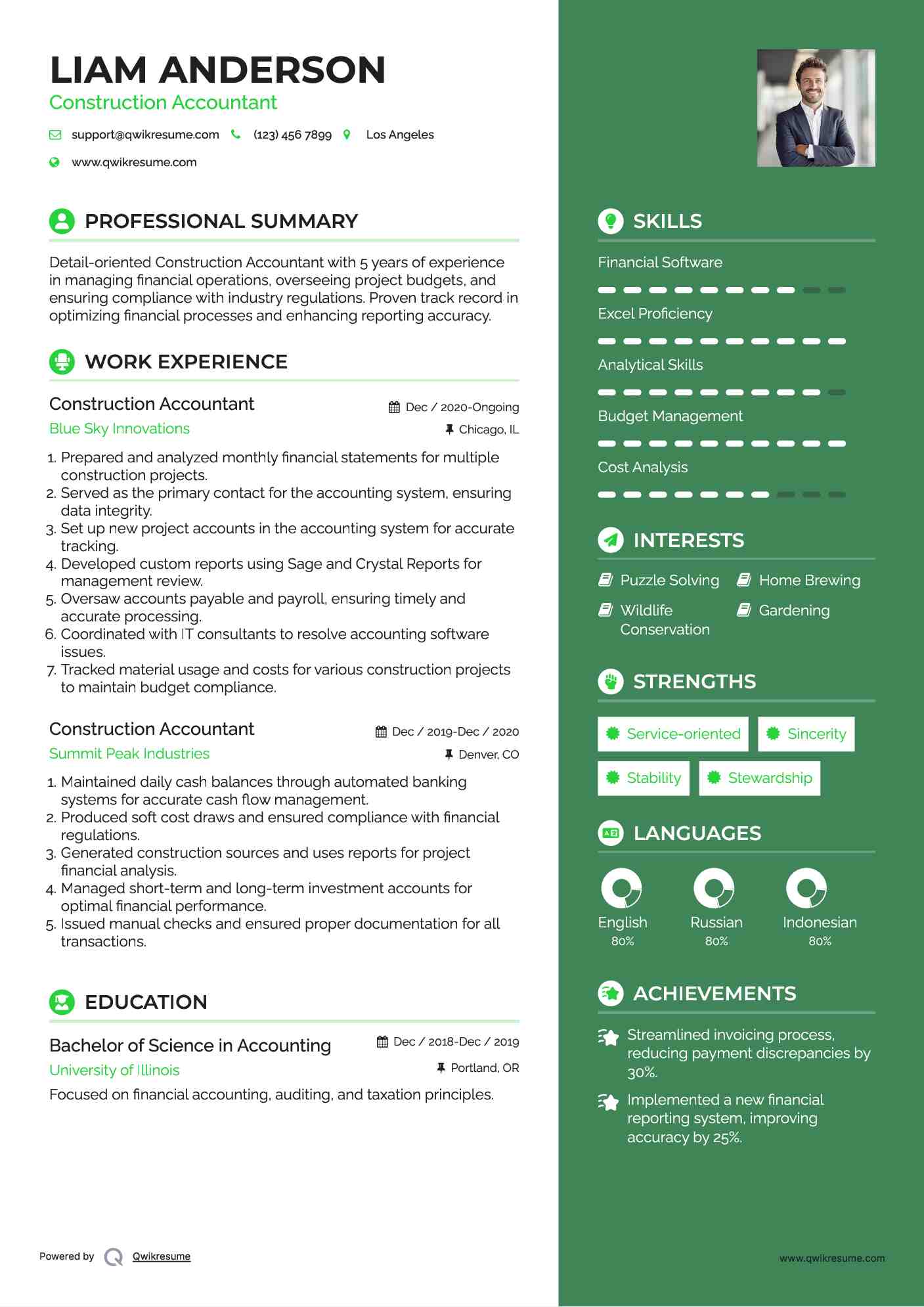

You will assist support the Accel group to guarantee distribution of successful on schedule, on spending plan, projects. Accel is looking for a Construction Accounting professional for the Chicago Workplace. The Building Accounting professional does a variety of accountancy, insurance coverage compliance, and job management. Works both separately and within certain divisions to maintain monetary documents and make sure that all records are kept present.

Principal responsibilities include, however are not limited to, managing all accounting features of the business in a prompt and precise way and supplying records and schedules to the firm's certified public accountant Company in the prep work of all economic declarations. Makes certain that all audit treatments and features are handled precisely. In charge of all monetary records, payroll, banking and daily procedure of the audit feature.

Prepares bi-weekly trial equilibrium records. Works with Task Supervisors to prepare and publish all regular monthly billings. Procedures and issues all accounts payable and subcontractor settlements. Creates regular monthly wrap-ups for Employees Payment and General Liability insurance policy premiums. Creates regular monthly Job Price to Date reports and working with PMs to integrate with Job Managers' allocate each job.

Some Known Incorrect Statements About Pvm Accounting

Proficiency in Sage 300 Building And Construction and Property (formerly Sage Timberline Workplace) and Procore building and construction management software application an and also. https://www.dreamstime.com/leonelcenteno_info. Must likewise be proficient in various other computer system software systems for the preparation of records, spread sheets and other accountancy evaluation that might be required by administration. construction taxes. Need to have solid organizational skills and capability to focus on

They are the economic custodians that make certain that construction projects stay on budget plan, abide by tax obligation laws, and maintain financial transparency. Building accounting professionals are not simply number crunchers; they are strategic partners in the construction process. Their primary role is to manage the economic facets of building and construction tasks, making certain that sources are alloted successfully and monetary dangers are reduced.

Everything about Pvm Accounting

They function carefully with project supervisors to produce and keep an eye on budget plans, track expenses, and projection monetary needs. By keeping a tight grip on task financial resources, accountants aid stop overspending and financial troubles. Budgeting is a foundation of successful building and construction jobs, and building accounting professionals are crucial in this regard. They create thorough budget plans that incorporate all job expenses, from products and labor to permits and insurance policy.

Navigating the complicated internet of tax guidelines in the building and construction industry can be tough. Building and construction accountants are skilled in these laws and guarantee that the project abides with all tax obligation requirements. This includes handling pay-roll tax obligations, sales taxes, and any other tax obligation commitments specific to building. To stand out in the duty of a construction accountant, individuals require a strong instructional foundation in bookkeeping and financing.

Additionally, certifications such as Qualified Public Accountant (CPA) or Qualified Building Industry Financial Specialist (CCIFP) are extremely regarded in the industry. Building and construction tasks often entail tight target dates, altering regulations, and unanticipated expenses.

A Biased View of Pvm Accounting

Specialist qualifications like certified public accountant or CCIFP are also highly recommended to demonstrate proficiency in building audit. Ans: Building and construction accounting professionals produce and keep an eye on budget plans, identifying cost-saving opportunities and making certain that the job remains within budget plan. They also track expenditures and forecast economic needs to avoid overspending. Ans: Yes, building and construction accountants manage tax obligation conformity for building tasks.

Intro to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make difficult options amongst many monetary choices, like bidding on one job over one more, picking financing for materials or devices, or establishing a project's revenue margin. In addition to that, construction is a notoriously unstable sector with a high failure rate, sluggish time to settlement, and inconsistent capital.

Normal manufacturerConstruction business Process-based. Manufacturing involves repeated procedures with quickly identifiable expenses. Project-based. Manufacturing needs various processes, products, and equipment with varying prices. Repaired area. Manufacturing or manufacturing happens in a solitary (or a number of) regulated places. Decentralized. Each task happens in a brand-new location with differing website conditions and distinct obstacles.

The Main Principles Of Pvm Accounting

Frequent usage of various specialized professionals and providers affects efficiency and cash money circulation. Repayment arrives in complete or with regular payments for the complete agreement amount. Some section of settlement may be held back up until project conclusion even when the professional's job is completed.

While typical manufacturers view it now have the benefit of regulated environments and enhanced manufacturing processes, building firms must regularly adjust to each new task. Even rather repeatable projects require alterations due to site problems and other aspects.

Report this page